That buyer can be bumped if a better offer comes along. For instance, a buyer may agree to buy the home only if they can sell their own home first. Bumpable buyerĪ buyer whose purchase agreement includes a contingency that allows the seller to continue to market the home to other prospective buyers. The backup puts the buyer in line to buy the home if the accepted offer falls through. Backup offerĪ backup offer is one made on a home where the seller has already accepted an offer. The ratio compares the borrower’s monthly debt payments to gross income. One of two debt-to-income ratios that a lender analyzes to determine a borrower’s eligibility for a home loan. Try our amortization calculator to learn more. If you have made your required monthly payments, at the end of the loan term (e.g., 15 or 30 year mortgage), you will own your home. Repayment of a mortgage over the loan term through regular monthly installments of principal and interest, based on an amortization schedule. Look for this accreditation or something similar when shopping for a home inspector.

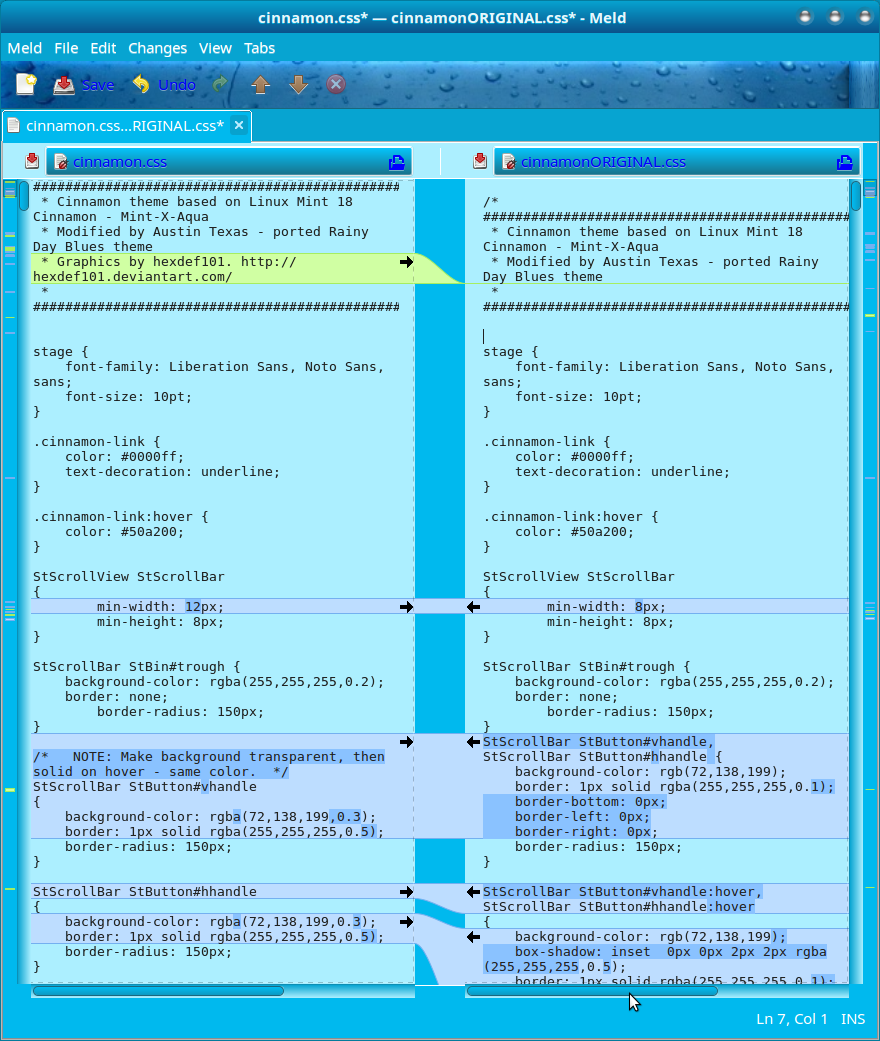

MELD DEFINITION PROFESSIONAL

American Society of Home Inspectors (ASHI)Ī not-for-profit professional association that sets and promotes standards for property inspections.

Try our affordability calculator to see how much house you might be able to afford.Ĥ. Home affordability assessments primarily take into account your income, down payment, and monthly debts. Experts say a home is considered affordable if the mortgage consumes no more than 30% of a household’s income. AffordabilityĪffordability or home affordability refers to the amount of money you can comfortably afford to spend on a home. Learn more about adjustable-rate mortgages. After the set time period your interest rate will change and so will your monthly payment. Adjustable-rate mortgage (ARM)Īn adjustable-rate mortgage, or ARM, has an introductory interest rate that lasts a set period of time and adjusts every six months thereafter for the remaining loan term. In the third year, the interest rate goes back to the fixed rate obtained from the lender. 2-1 BuydownĪ 2-1 buydown is a concession or incentive negotiated with a seller or builder that temporarily reduces a buyer’s mortgage interest rate by 2 percentage points the first year and 1 percentage point the second year of your mortgage. Keep this guide handy - you’ll be fluent in the language of home buying before you know it. When searching for a home or applying for a mortgage, you may hear your real estate agent or lender use any of the terms or acronyms below.

MELD DEFINITION LICENSE

MELD DEFINITION SOFTWARE

VA Software Documentation Library (VDL)Įstimating the severity of liver disease is important for predicting survival, assessing risk/benefit of specific treatments, including organ allocation for liver transplantation, and guiding goals-of-care discussions.Clinical Trainees (Academic Affiliations).War Related Illness & Injury Study Center.

0 kommentar(er)

0 kommentar(er)